The UK’s industrial strategy offers the perfect opportunity to start transforming the UK away from fossil gas. Over the medium term, the climate imperative requires the removal of carbon emissions and ‘unabated’ fossil fuels from the UK energy system (by 2050). However, economic and security issues mean that rapidly accelerating the rate of reduction within the UK’s energy system make sense in the short term.

The UK is reliant on gas for the majority of heating needs with around 85% of households connected to the network (Consumer Focus, 2013) and gas provides 71% of total heat demand (DECC, 2013). In 2015, gas was also used for 30% of the UK’s electricity generation (BEIS, 2016a). This reliance on gas is associated with large volumes of greenhouse gas emissions.

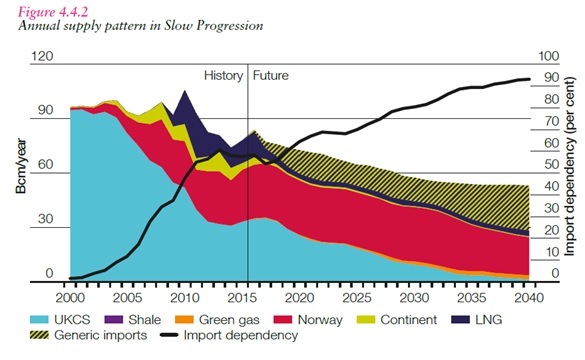

Due to the natural depletion of UK continental shelf gas fields (National Grid, 2016) the UK is increasingly reliant on gas imports primarily from Norway, but also often from further afield with Liquefied Natural Gas sometimes coming from as far away as Qatar. This reliance on imports is expected to increase from the 50% current level of import dependency to over 90% by 2040 (National Grid, 2016). In 2000, the UK was fully self-sufficient for gas consumption giving an idea of the speed of this change.

The recent historical change and potential future gas import dependency and gas sources based on the National Grid ‘Slow Progression’ scenario is shown below in figure 1. It is worth noting that National Grid’s ‘Gone Green’ scenario shows a very similar pattern.

Figure 1. Historical and projected UK gas imported dependency and gas sourcing (National Grid, 2016)

As well as the imperative of carbon reduction which requires the removal of (unabated) fossil gas from the UK’s heat and electricity system by 2050, the increasing reliance on imports further makes clear why a move away from gas is necessary. The UK is increasingly exposed to volatile global gas prices and the reliance on imports also has clear implications for energy security. The more you import, the higher the security risk.

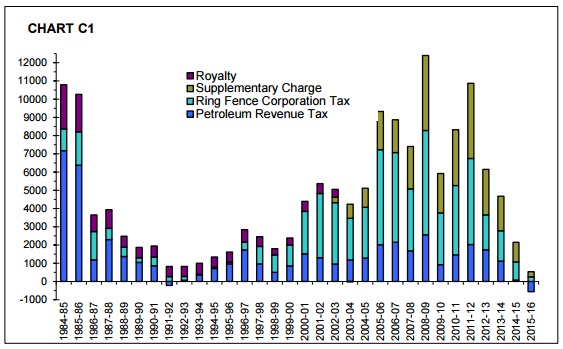

But the increasing reliance on imported gas has major UK macro-economic implications which are rarely considered by energy policy makers. Firstly, the UK tax take from natural gas production has reduced significantly, this has been a result of the reduction in the wholesale price of gas as well as the reduction in the volumes of gas produced. The rapid combined reduction in tax take from oil and gas production (generally produced together) is shown in figure 2. In 15/16, an overall loss was reported by Government (possible due to decommissioning costs and tax offsetting) whereas in 11/12, UK oil and gas tax receipts were over £11 billion (HM Revenue and Customs 2017); this 11/12 tax take is similar to the expected cost of the entire UK smart meter rollout (BEIS, 2016b). It is worth noting that figure 2 shows direct hydrocarbon production taxes, other associated tax take such as income tax and NI is not included implying that the total reduction in tax take may higher.

Figure 2. Changing UK tax take from oil and gas production for 2015 (HM Revenue and Customs, 2017)

Importing natural gas also requires exporting UK cash to pay for it. This is clearly damaging for the UK’s balance of payments and there are wider economic impacts as all of the associated investment and associated multiplier effects once associated with gas production are no-longer in the UK and contributing to UK Plc.

To make things even worse, analysis by consultants reported in the Financial Times suggested that there was unlikely to be an future revenue from North Sea gas fields and the sectors would become a net cost to the UK Government (in the region of £24 billion) due to reduced income and tax reliefs associated with decommissioning (Financial Times, 2016). Whilst some (industry bodies) have suggested that unconventional gas could provide an increasing level of gas demand in the future (Institute of Directors, 2013), not even the most extreme scenarios see shale gas able to fill the UK’s current and future import dependency .

These economic import dependency issues have historically not really been considered by politicians and policy makers perhaps due to the UK’s laissez-faire approach to the gas market and gas sourcing, something that in the more nationally focussed Brexit and Trump era may well change. In fact, the BEIS consultation into boiler standards which concluded in January said ‘Almost 80% of domestic heat is currently generated by gas, the majority of which is now imported from overseas’ (BEIS, 2016c). This is the first time (in ten years) I have seen the UK Government recognise the role of heat policy in reducing reliance on gas imports as well as cutting carbon and bills, certainly a step in the right direction.

However, words are not enough and through the industrial strategy the Government must deliver on its historically poor performance at reducing gas demand and promoting home-grown renewable heat sources.

Known simple and cost effective technologies, particularly for the heat sector can reduce heat and gas demand (and carbon). This is not complicated stuff – insulation, air tightness and better windows – and these are already needed for the ‘cold man of Europe’ (so-called due to the UK’s poor building standards and associated damp and cold living conditions) (Association for the Conservation of Energy, 2015). There are also known and proven technologies for switching buildings completely away from gas, such as heat pumps and district heating – already seen as necessary under carbon reduction commitments.

In light of all of these issues associated with the UK’s gas use, the industrial strategy is the perfect opportunity for the Government to begin the rapid transformation away from high carbon and now economically damaging natural gas.

References

Association for the Conservation of Energy, 2015. The Cold Man of Europe – 2015 Update, Available at: http://www.ukace.org/wp-content/uploads/2015/10/ACE-and-EBR-briefing-2015-10-Cold-man-of-Europe-update.pdf.

BEIS, 2016a. Digest of United Kingdom Energy Statistics, London. Available at: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/552060/DUKES_2016_FINAL.pdf.

BEIS, 2016b. Smart meter roll-out cost benefit analysis – Part I. , (August), pp.1–30. Available at: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/567167/OFFSEN_2016_smart_meters_cost-benefit-update_Part_I_FINAL_VERSION.PDF.

BEIS, 2016c. The Future of Heat : Domestic buildings, Available at: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/575299/Heat_in_Buildings_consultation_document_v1.pdf.

Consumer Focus, 2013. Off-gas consumers Information on households without mains gas heating, Available at: http://www.consumerfocus.org.uk/files/2011/10/Off-gas-consumers.pdf.

DECC, 2013. Estimates of heat use in the United Kingdom in 2012, London. Available at: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/244735/4_estimates_of_heat_use_in_the_uk_2012.pdf.

Financial Times, 2016. UK faces £24 billion bill for shutting North Sea fields. Available at: https://www.ft.com/content/9b1d17d0-d425-11e6-b06b-680c49b4b4c0 [Accessed March 7, 2017].

HM Revenue & Customs, 2017. Statistics of Government revenues from UK oil and gas production. , pp.1–18. Available at: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/429575/Statistics_of_Government_revenues_from_UK_oil_and_gas_production.pdf.

Institute of Directors, 2013. Getting shale gas working. , p.188. Available at: http://www.iod.com/~/media/Documents/PDFs/Influencing/Infrastructure/IoD_Getting_shale_gas_working_MAIN_REPORT.pdf.

National Grid, 2016. Future Energy Scenarios, Warwick. Available at: http://fes.nationalgrid.com/fes-document/v.

Leave a comment